Key Takeaways

- Prioritize personal safety before anything else.

- Thorough documentation is crucial to the successful processing of insurance claims.

- Timely reporting to your insurance provider is crucial.

- Undertake temporary repairs only to prevent further damage.

- Keep all communication and expense records throughout the recovery process.

- Engage professionals when needed and beware of scams.

- Reassess your insurance coverage once you have resolved the initial issues.

Property damage can disrupt your daily life and leave you uncertain about your next steps. In these stressful moments, a clear plan can help minimize further loss and streamline the recovery process. This guide walks you through the essential immediate actions to take after experiencing property damage, ensuring you safeguard your family, belongings, and finances. If you need reliable professional help during this process, Remedics offers straightforward support and services to ease your burden.

Few events disrupt life like unexpected property damage, but immediate actions are vital. Prioritize safety, document damages, communicate promptly, and make smart decisions. These steps protect assets, facilitate insurance claims, and expedite recovery. Recording damages and expenses supports claims and keeps you organized. Immediate repairs, working with experts, and staying vigilant against scams will streamline the recovery process. Understanding and updating your insurance policy enhances future protection.

Prioritize Safety

Your priority after property damage is to ensure your personal safety. Avoid entering premises if there are structural issues, gas leaks, exposed wires, or standing water near electrical sources. Wait for authorities to confirm it is safe to return after a disaster. If hazards like fire or flood occur, evacuate immediately and contact emergency services. Never attempt to turn utilities back on yourself in severe damage situations—trust professionals to handle utilities safely.

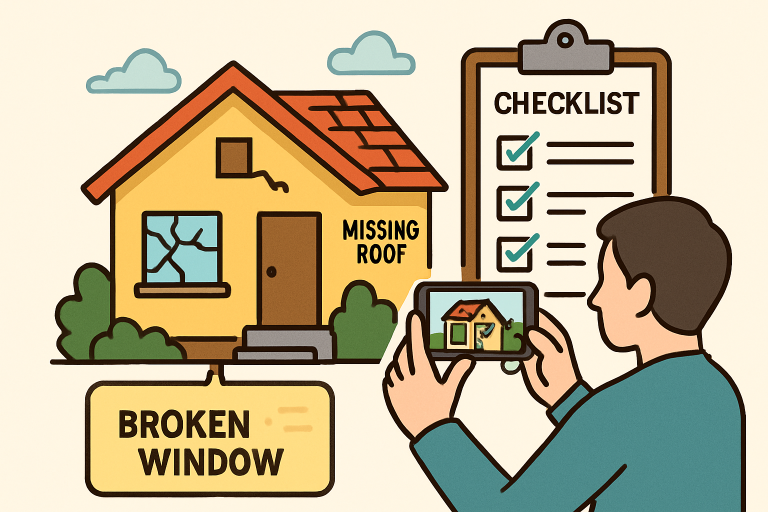

Document the Damage

When safe, document all damage systematically. Take high-resolution photos and videos from multiple angles. Catalog damaged items with details like make, model, and value. This documentation helps convince insurance adjusters and prevents overlooked details. Use your smartphone or camera, and back up files to the cloud or an external drive. Creating an inventory speeds up claims by organizing photos and notes about affected rooms, property categories, and damage timeline.

Contact Your Insurance Provider

Act promptly to notify your insurance provider about the incident, as most providers expect prompt reporting following disasters. Share your initial findings, and prepare to send photos, inventory, and requested docs. Keep a log of contacts, dates, and discussions for future reference. This communication trail can help if you need to escalate your claim. Adjusters will likely schedule an inspection before making repairs, so avoid discarding damaged items unless they are unsafe.

Prevent Further Damage

Once your claim is underway, address immediate vulnerabilities to prevent secondary damage. Cover broken windows, place tarps on exposed roofs, and shut off water or utilities as needed. Save receipts for any emergency purchases such as plywood, tarps, or pumps. Insurers often reimburse these reasonable, temporary expenses. Never undertake large-scale or permanent repairs before the adjuster’s visit—this can compromise your claim.

Keep Detailed Records

Throughout the process, maintain a detailed record of every communication with your insurance company and contractors. Include dates, points discussed, email confirmations, and copies of receipts and invoices. These records help resolve disputes and provide transparency if questions arise during the claims process. Store your documentation in both hard copy and digital formats, if possible, for redundancy.

Seek Professional Assistance

In many cases, hiring a licensed contractor or a reputable public adjuster can be invaluable. Professionals can reveal hidden or structural damages that might be overlooked in a DIY assessment, and they also provide trustworthy repair estimates necessary for your claim. When selecting a contractor, verify their licensing, insurance coverage, and references to ensure peace of mind.

Be Cautious of Scams

Sadly, post-disaster situations often attract unscrupulous contractors. Never feel pressured to sign a contract or make a large upfront payment. Verify each contractor’s credentials, insurance, and history before agreeing to any work. You may also want to consult consumer protection agencies or local government sites for updated scam alerts and safe hiring checklists.

Review and Update Your Insurance Policy

Once immediate threats are handled and recovery begins, review your insurance policy. Check coverage limits, deductibles, exclusions, and claim requirements. Updating your policy to close gaps enhances protection and peace of mind. These steps safeguard property and finances, making recovery smoother. Preparation now and proper response after an incident are crucial to resuming everyday life.

Conclusion

Recovering from property damage requires caution, organization, and preparedness. Prioritizing safety helps avoid further risks, while documenting and communicating with your insurer support a successful claim. Preventing additional damage, keeping records, and seeking professional advice strengthen recovery. Stay alert to scams and update your policy once stable to protect your property and prepare for future emergencies. These steps turn stress into a structured recovery.