In 2025, as cryptocurrency adoption accelerates globally, understanding how to use a crypto wallet is more critical than ever. Whether you’re holding assets for the long term or actively trading daily, choosing the right wallet setup is essential for managing digital assets securely and efficiently.

Crypto wallets are the gateway to Web3, decentralized finance (DeFi), and digital asset ownership. Yet, many new users misunderstand what wallets actually do and how to differentiate between hot and cold storage solutions. This guide breaks down the core functions of crypto wallets, the differences between hot and cold wallets, and how to use them properly in today’s market.

What Is a Crypto Wallet?

A crypto wallet is a tool that stores your private keys, which grant access to your cryptocurrency on the blockchain. Contrary to popular belief, the wallet does not hold the crypto itself. Instead, it manages your keys and allows you to send, receive, and interact with blockchain-based assets. For example, users checking live market data such as PI coin price still rely on their wallets to securely execute transactions.

Crypto wallets come in two main types:

- Hot Wallets: Connected to the internet

- Cold Wallets: Offline and air-gapped for security

Before selecting a wallet, it’s important to assess your priorities, such as ease of access, security, and asset volume.

Hot Wallets Explained

What Is a Hot Wallet?

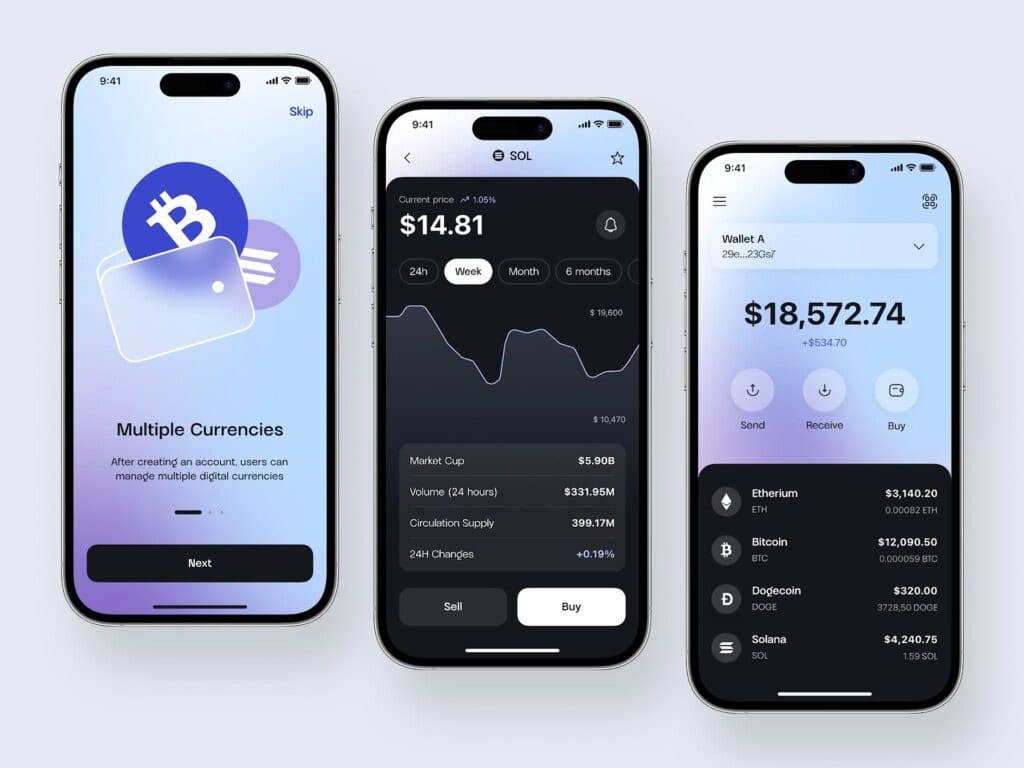

A hot wallet is a cryptocurrency wallet that is connected to the internet. These are typically software-based applications accessible via desktop, mobile, or web browsers. Because they are online, hot wallets offer speed and convenience, making them ideal for users who trade or transact frequently.

Common Types of Hot Wallets

- Mobile wallets: Apps like MEXC’s trading platform or Trust Wallet

- Web wallets: Browser extensions such as MetaMask

- Desktop wallets: Electrum or Exodus for PC/Mac

- Exchange wallets: Wallets hosted on exchanges like MEXC, allowing users to trade instantly across popular pairs such as DOGE USDT or other trending cryptocurrencies without leaving the platform.

Advantages

- Instant access for trading, staking, and transferring assets

- User-friendly interfaces for beginners

- Seamless integration with DeFi platforms and dApps

Risks and Considerations

- Higher vulnerability to phishing attacks, malware, and hacks

- Security depends on the device and user practices

- Not ideal for storing large amounts of crypto

Tip: Always enable 2FA, use strong passwords, and avoid using hot wallets on shared or unsecured devices.

Cold Wallets Explained

What Is a Cold Wallet?

Cold wallets are offline wallets designed to store private keys securely without internet exposure. They are preferred for long-term holders (“HODLers”) and institutional-grade security needs.

Common Types of Cold Wallets

- Hardware wallets: Devices like Ledger and Trezor

- Paper wallets: Printed QR codes or keys

- Air-gapped devices: Offline computers used solely for signing transactions

Advantages

- Immune to online hacking attempts

- Ideal for securing large balances over long periods

- Often used by high-net-worth individuals and institutions

Risks and Considerations

- Requires technical knowledge to set up and use

- Physical loss or damage can result in permanent access loss

- Inconvenient for active trading

Note: Always back up your recovery seed phrase in multiple secure, offline locations.

Hot vs. Cold Wallet: Which Should You Use?

Key Differences at a Glance

| Feature | Hot Wallet | Cold Wallet |

| Internet Access | Always online | Fully offline |

| Security Risk | Moderate to high | Very low |

| Accessibility | High (real-time) | Low (manual steps required) |

| Best Use Case | Daily trading, quick access | Long-term holding, security |

| Cost | Often free | May require hardware purchase |

Choosing Based on Use Case

- Daily traders: Prefer hot wallets for speed and convenience

- Long-term holders: Opt for cold wallets to minimize risk

- Hybrid approach: Use both to balance accessibility and security

Many MEXC users, for example, hold a portion of assets in their exchange wallet for trading while storing the rest in a hardware wallet for safekeeping.

How to Set Up and Use a Crypto Wallet

For Hot Wallets:

- Choose a wallet: e.g., MEXC’s in-app wallet, MetaMask, Trust Wallet

- Download and install from official sources only

- Create a wallet and securely write down the recovery phrase

- Set up security features like 2FA and biometric access

- Fund your wallet by transferring crypto or buying directly via the platform

For Cold Wallets:

- Purchase a hardware wallet from a verified seller

- Initialize the device and generate a recovery seed

- Install companion software to manage assets offline

- Transfer funds from your exchange or hot wallet

- Disconnect from the internet after use

Security Best Practices (2025 Update)

As wallet-targeted attacks have become more sophisticated in 2025, it’s important to:

- Use hardware wallets with firmware update alerts

- Avoid connecting wallets to unknown dApps

- Store recovery phrases offline, never digitally

- Enable multi-signature authentication where available

- Verify smart contract permissions before approving transactions

Recent Trends: Wallet Usage in 2025

- Meme coin and AI token surges have led to increased mobile wallet adoption

- Institutional adoption is rising, with more firms using multisig cold wallets

- Phishing attacks via fake wallet apps are at an all-time high

- MEXC users increasingly split funds between futures wallets and cold storage for safety

FAQs About Crypto Wallets

What is the safest type of crypto wallet?

Cold wallets are considered the safest because they remain offline and are immune to most forms of cyber attacks.

Can I use both hot and cold wallets?

Yes. A hybrid setup is recommended to balance convenience and security.

Is a crypto exchange wallet safe?

Exchange wallets like MEXC offer high-level security, but users should still use 2FA and not store large balances there long-term.

What happens if I lose my recovery phrase?

Without the recovery phrase, your wallet cannot be recovered. It is crucial to store it securely offline.

Are crypto wallets free?

Most hot wallets are free. Cold wallets (hardware) must be purchased.

Final Thoughts

Using a crypto wallet effectively in 2025 requires more than just downloading an app or buying a hardware device. It demands a clear understanding of wallet types, security measures, and how to manage risk in a rapidly evolving space.

For users trading actively or holding assets, MEXC provides a secure ecosystem with access to over 3,000 cryptocurrencies, including trending tokens and futures contracts. Whether you prefer speed, security, or both, integrating hot and cold wallets into your strategy can help protect your digital wealth.